Overview of Exness Account Types|Features and Recommendations

Recommended Account Types for Exness Users

Exness offers a variety of account types tailored to different trading needs and preferences.

There are various information and opinions on the official website and other websites, so you may have a hard time choosing the best one.

In addition, we are going to compare them on the premise that you are using Trader Cashback, so if you have not received cashback yet, please take this opportunity to use it.

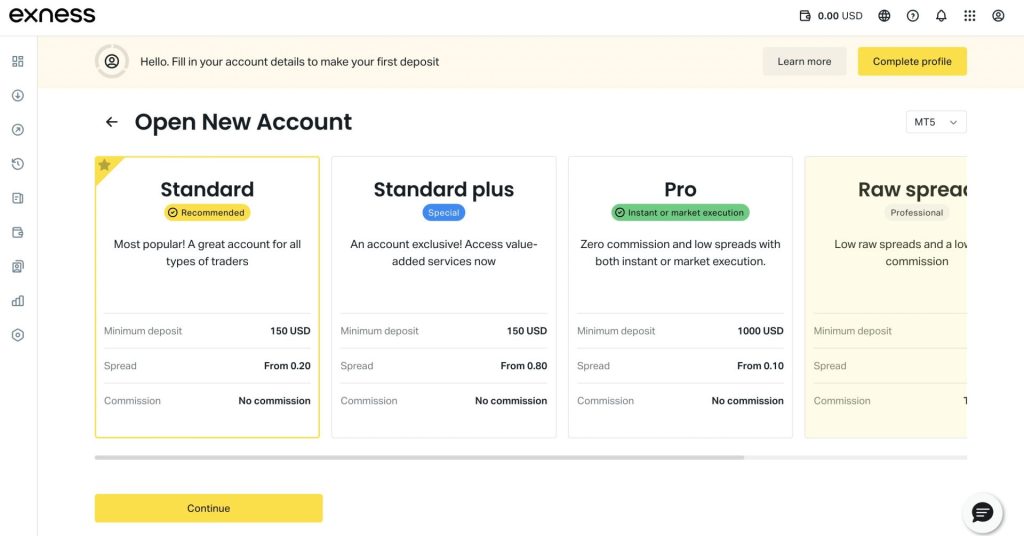

List of Exness Account Types and Features

Exness offers 4 account types to meet a variety of needs. (excluding the Standard Cents account).

They are Standard Account, Pro Account, Zero Account, and Low Spread Account.

Each type has distinct features related to spreads, commissions, and the range of tradable instruments.

We will begin with a brief introduction to each.

Standard Account

Standard account is the most common account type at Exness, recommended for beginners.

It is well-suited for day trading and swing trading but less so for scalping due to wider spreads.

- Easy to handle even for beginners

- No minimum deposit

- No trading commissions

- High cash back rate

- Recommended for index trading

- Largest number of stocks handled

- Wide spread, not suitable for scalping

The Standard account is suitable for

- Those who invest less than 999USD.

- Swing traders

- Indicator traders

- Those who want to trade for cash back purposes.

Pro Account

The Pro account is the most recommended for all levels of traders and trading styles, including scalping, day trading, and swing trading.

- Lowest trading costs

- Almost no slippage

- Largest number of stocks

- Requotes will occur

- Minimum deposit of 1000 USD

Who the Pro Account is Suitable For

・Scalping with high leverage

・All beginners to advanced traders, etc.

The Pro account is the most recommended account type

Zero Account

The Zero account has very narrow spreads and, like the Pro account, is the recommended account type for scalping.

There are separate transaction fees for the Zero account and the Low Spread account, which we will introduce next.

- Zero spread on the top 30 most actively traded stocks

- No requotes, unlike the Pro account

- Separate commissions (starting from 0.2 USD each way per lot)

- Fixed cashback amount

- Minimum deposit of 1000 USD

Who is recommended to use the Zero account?

- Scalpers

- Traders who prefer fixed spreads without requotes

Even though the spread is zero, the transaction cost is higher than the pro account due to commissions.

Low Spread Account

The Low Spread account has a narrow spread and, like the Zero account, is suitable for scalping.

Basically, the performance is not that different from the Zero account.

- Narrow spreads

- No requotes, unlike the Pro account

- Separate commission fee (3.50USD each way per lot)

- Fixed cash back amount

- Initial deposit amount is 1000USD

Who is recommended to use a low spread account?

・Scalpers

・Traders who prefer fixed spreads without requotes

The Low Spread account is not much different from the Zero account, but the Pro account is basically recommended.

Zero account and low spread account commissions are charged for both placing and closing orders. One way refers to the commission charged for one side. If the commission is 3.50USD each way per lot, the total cost is 7USD (3.5 for placing the order and 3.5 for settling the order).

Account Type Comparison

Below is a comparison chart for each account type.

(Items common to all accounts, such as maximum leverage and stop levels, are omitted.)

| Account Type | Standard Account | Pro Account | Zero Account | Low Spread Account |

|---|---|---|---|---|

| Minimum Deposit | 1USD〜 | 1000USD〜 | 1000USD〜 | 1000USD〜 |

| Order Type | Market Execution | Instant Execution | Market Execution | Market Execution |

| Separate Transaction Fee | × | × | ◯ | ◯ |

| Cashback | 34% of the spread | 21.25% of the spread | 0.85-168USD | 0.85-168USD |

Professional accounts are also used for market execution for virtual currency trading.

Pro account is recommended as a basic account.

We recommend the Pro account as a basic account for beginners and advanced traders of any trading style.

FAQs

A.Yes, you can.

You can create up to a total of 200 accounts (MT4 max 100, MT5 max 100).

A.Yes, you can create multiple Exness accounts with different email addresses.

A.Using the Exness app’s one-click trading might facilitate smoother execution compared to MT4/MT5.

A.Exness allows you to make trades by transferring funds out of your account, so it is recommended that you open about 3 accounts.

Conclusion

For most trading activities, the Pro account is the best option at Exness.

If you trade with Exness, be sure to take advantage of the cashback service.

Exness accounts opened with Trader Cashback are now also eligible for cash back, so take advantage of it. If you already have an Exness account, you can either

(1) apply for an IB change or (2) create a new Exness account. Once you have opened an Exness account, don’t forget to register your account on Trader Cashback’s My Page!